Consumer Cyclical -

Auto - Manufacturers - NYSE - IT

$ 490.2

-0.277 %

$ 87.4 B

Market Cap

48.53

P/E

1. INTRINSIC VALUE

Balance Sheet

Ferrari N.V.

| Current Assets | 5.02 B |

| Cash & Short-Term Investments | 1.75 B |

| Receivables | 2.08 B |

| Other Current Assets | 1.19 B |

| Non-Current Assets | 4.48 B |

| Long-Term Investments | 80.8 M |

| PP&E | 1.83 B |

| Other Non-Current Assets | 2.57 B |

| Current Liabilities | 1.49 B |

| Accounts Payable | 946 M |

| Short-Term Debt | 0 |

| Other Current Liabilities | 545 M |

| Non-Current Liabilities | 4.46 B |

| Long-Term Debt | 3.35 B |

| Other Non-Current Liabilities | 1.11 B |

EFFICIENCY

Earnings Waterfall

Ferrari N.V.

| Revenue | 6.68 B |

| Cost Of Revenue | 3.33 B |

| Gross Profit | 3.35 B |

| Operating Expenses | 1.46 B |

| Operating Income | 1.89 B |

| Other Expenses | 362 M |

| Net Income | 1.53 B |

RATIOS

FREE CASH FLOW ANALYSIS

Free Cash Flow Analysis

Ferrari N.V.

| Net Income | 1.53 B |

| Depreciation & Amortization | 667 M |

| Capital Expenditures | -989 M |

| Stock-Based Compensation | 0 |

| Change in Working Capital | -383 M |

| Others | -267 M |

| Free Cash Flow | 938 M |

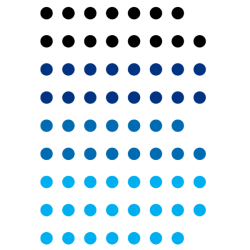

Wall Street Analysts Price Targets

Ferrari N.V.

Wall Street analysts predict an average 1-year price target for RACE of $526 , with forecasts ranging from

a

low of

$460 to a high of $565 .

RACE Lowest Price Target

Wall Street Target

460 USD

-6.16%

RACE Average Price Target

Wall Street Target

526 USD

7.35%

RACE Highest Price Target

Wall Street Target

565 USD

15.26%

4. DIVIDEND

ANALYSIS

0.00%

DIVIDEND YIELD

3.39 USD

DIVIDEND PER SHARE

5. COMPETITION

slide 2 of 8

6. Ownership

Insider Ownership

Ferrari N.V.

Sold

0-3 MONTHS

0 USD 0

3-6 MONTHS

0 USD 0

6-9 MONTHS

0 USD 0

9-12 MONTHS

0 USD 0

Bought

0 USD 0

0-3 MONTHS

0 USD 0

3-6 MONTHS

0 USD 0

6-9 MONTHS

0 USD 0

9-12 MONTHS

7. News

Ferrari Shines Brightest In Exor's Holdings

Exor trades at an 88% NAV discount, which, we believe, is unjustified given its diversified holdings and substantial Ferrari stake. While Stellantis faces challenges, Exor's exposure to more resilient assets, along with a now de-risked position in Philips, underpins a constructive view. With a robust balance sheet, an ongoing buyback, and a solid track record, we remain buyers of EXXRF.

seekingalpha.com

- 2 weeks ago

Ferrari wins back rights to Testarossa brand at EU court

Ferrari on Wednesday scored a win at the EU's second-highest court, which said the luxury sportscar maker had been wrongfully stripped off the rights to the Testarossa brand name.

reuters.com

- 2 weeks ago

Ferrari unveils new 'Amalfi' petrol coupe ahead of EV launch

Ferrari revealed its new Amalfi coupe on Tuesday as the luxury sportscar maker mixes petrol and hybrid models in its range while preparing for the launch of its first fully electric vehicle.

reuters.com

- 2 weeks ago

3 International Growth Stocks To Buy Now

The U.S. stock market is dominated by companies that are headquartered in the United States, but there are also a bunch of international stocks that present enticing long-term opportunities.

247wallst.com

- 3 weeks ago

INTU & RACE Are 2 of the Best Momentum Stocks to Buy Now

INTU and RACE rise to the top as momentum picks, driven by strong earnings surprises and up-trending price signals.

zacks.com

- 4 weeks ago

STRT or RACE: Which Is the Better Value Stock Right Now?

Investors looking for stocks in the Automotive - Original Equipment sector might want to consider either Strattec Security (STRT) or Ferrari (RACE). But which of these two stocks presents investors with the better value opportunity right now?

zacks.com

- 1 month ago

Exclusive: Ferrari delays second EV model to at least 2028 because of weak demand, sources say

Ferrari has delayed plans for its second fully-electric model that was due out in 2026 to at least 2028, because of a lack of demand for high-performance luxury EVs, two sources close to the matter told Reuters.

reuters.com

- 1 month ago

Is Ferrari Stock Poised to Race Higher?

Benefiting from its strong brand and pricing power, Ferrari (RACE) stock is up a respectable +13% in 2025 and is sitting on gains of over +180% in the last three years.

zacks.com

- 1 month ago

Stellantis, Ferrari workers in Italy agree salary increases over 2025-2026 period

Italy's largest automotive groups, led by Stellantis , and unions on Friday signed an agreement for an overall 6.6% salary increase over the 2025-2026 period for their workers in Italy, further helping them cover the inflation peak in recent years.

reuters.com

- 1 month ago

Ferrari: The Underrated Potential Of Non-Car Revenues

Ferrari's exceptional pricing power and brand strength drive consistent outperformance, with management focused on quality over quantity in revenue growth. Non-car revenues — lifestyle, brand, sponsorships, and racing — are growing faster than car sales and represent a major, underappreciated growth driver. Despite high valuation multiples, Ferrari's unique moat, resilient demand, and strong earnings growth justify a premium and support continued market-beating returns.

seekingalpha.com

- 1 month ago

New Strong Buy Stocks for June 4th

BCRX, OPRX, BWB, PLMR and RACE have been added to the Zacks Rank #1 (Strong Buy) List on June 4, 2025.

zacks.com

- 1 month ago

CTTAY vs. RACE: Which Stock Is the Better Value Option?

Investors with an interest in Automotive - Original Equipment stocks have likely encountered both Continental AG (CTTAY) and Ferrari (RACE). But which of these two stocks is more attractive to value investors?

zacks.com

- 1 month ago

8. Profile

Summary

Ferrari N.V. RACE

COUNTRY

IT

INDUSTRY

Auto - Manufacturers

MARKET CAP

$ 87.4 B

Dividend Yield

0.00%

Description

Ferrari N.V., through its subsidiaries, designs, engineers, produces, and sells luxury performance sports cars. The company offers sports, GT, and special series cars; limited edition hyper cars; one-off and track cars; and Icona cars. It also provides racing cars, and spare parts and engines, as well as after sales, repair, maintenance, and restoration services for cars. In addition, the company licenses its Ferrari brand to various producers and retailers of luxury and lifestyle goods; Ferrari World, a theme park in Abu Dhabi, the United Arab Emirates; and Ferrari Land Portaventura, a theme park in Europe. Further, it provides direct or indirect finance and leasing services to retail clients and dealers; manages racetracks, as well as owns and manages two museums in Maranello and Modena, Italy; and develops and sells a line of apparel and accessories through its monobrand stores. As of December 31, 2021, it had a total of 30 retail Ferrari stores, including 14 franchised stores and 16 owned stores. The company also sells its products through a network of 172 authorized dealers operating 191 points of sale worldwide, as well as through its website, store.ferrari.com. Ferrari N.V. was founded in 1947 and is headquartered in Maranello, Italy.

Contact

Via Abetone Inferiore n. 4, Maranello, MO, 41053

https://www.ferrari.com

IPO

Date

Oct. 21, 2015

Employees

5465

Officers

Mr. Flavio Manzoni

Chief Design Officer

Mr. Carlo Daneo

General Counsel

Mr. Michele Antoniazzi

Chief Human Resources Officer

Mr. John Jacob Philip Elkann

Executive Chairman

Mr. Davide Abate

Chief Technologies & Infrastructures Officer

Mr. Marco Lovati

Chief Internal Audit, Risk and Compliance Officer

Mr. Enrico Galliera

Chief Marketing & Commercial Officer

Ms. Nicoletta Russo

Head of Investor Relations

Mr. Benedetto Vigna

Chief Executive Officer & Executive Director

Mr. Antonio Picca Piccon

Chief Financial Officer